Online will kits: Whos using them and how do they compare to a lawyer?

Through these schemes, a solicitor will write or update your will and the charity will cover their fees. In exchange, it’s recommended you leave a gift to the charity in your will – although you don’t have to. That goes double if you have a complicated or particularly large estate.

These gifts are deducted from your estate before it is divided among your beneficiaries. It is, however, not a requirement that any specific gift is left. In that case, your estate will be divided per the wishes outlined for your residuary estate. Having a legal will is essential for your family’s future and to make sure that they are cared for and protected. Understanding the legal requirements for wills in Ontario and learning more about the ways to draft a will can help you start the process or keep your current documents updated. If you already have a will drafted and recently experienced a major life milestone, it’s important to revisit and update your document to make sure it reflects any changed assets and wishes.

Are Online Wills Legal?

Keep in mind that it’s not necessary to include a list of all your assets in your will. Your will already covers your umbrella estate (everything you own). If you want to include a full detailed list to help your executor, you can compile a list of assets separate from your will and store it with your document along with other estate planning documents. This is not a legally-binding document but will serve as a blueprint for your loved ones.

A Lawyer’s Guide to Drafting a Will

Read more about will template word document here.

For example, if you feel your wishes and your estate are relatively simple, you could hire a lawyer to review a will you create on your own, as opposed to having the lawyer create one for you. Fortunately, there are resources to help you write a will and to decide what approach you will take. There is no legal obligation to write a will, but having one is important because it helps ensure your wishes are carried out after you die. This can include who receives your assets, such as cash savings, stocks or real estate. It can also include instructions about who’ll care for your children or other dependents, how you want to be remembered in ceremonies, such as a funeral, and even how your remains are disposed of.

These rules can differ between the Australian states, but your next of kin will typically be responsible for your estate. This is why writing a will can be so important, as the law’s distribution of your assets might not match your wishes. The executor must also file a final income tax return for the deceased and pay any estate taxes owed. For a complex estate, they may have to follow the probate process to settle the estate. There is nothing that you can write into your Will that will ever ‘guarantee’ or prevent someone from trying to challenge your bequests after your death.

In many cases, this can be a simple declaration of your wishes for how yourestate should be distributed, and this can be achieved by working through theMyWill™ wizard here atUSLegalWills.com. You should draft a Will whileyou are still young and healthy, even if you don’t feel that your assets aresubstantial. There is absolutely no benefit in waiting until you areolder.

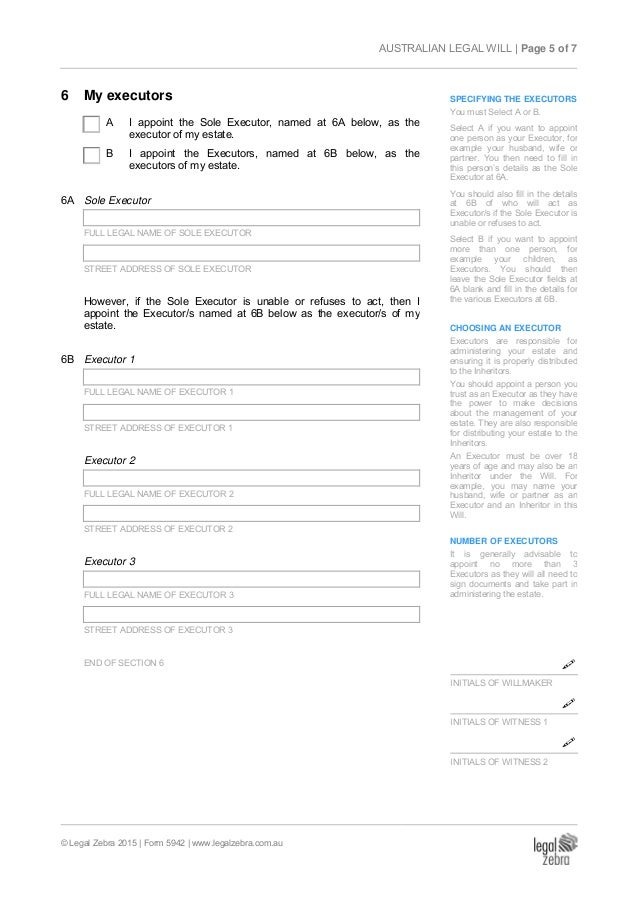

You must sign your Will yourself in the presence of two witnesses; they must be at least 18 years old and cannot be beneficiaries. The witnesses do not need to read the document or even know what it contains. Instead, they must simply watch to see that it was you who signed the document. You must sign your full signature on each page and then sign and date the last page. But bear in mind that an executor doesn’t have to be a beneficiary. For example, you may decide to have your solicitor or family friend act as your executor. You should choose at least two executors, as by the time you die, one may not be available or willing to act as your executor.

If you include a general provision, you can state that you want everything not otherwise mentioned to go to a particular heir, charity or the estate. But if you leave that out (and why would you?), it will all be subject to your state’s intestacy laws.

Leave a Reply