Maximizing Success with the Right Accountant for Small Business

Running a small business comes with its own set of challenges. From managing day-to-day operations to staying on top of finances, there’s a lot that goes into keeping your business afloat. One key aspect that can greatly impact the success of your small business is having the right accountant by your side.

Why is an Accountant Important for Small Businesses?

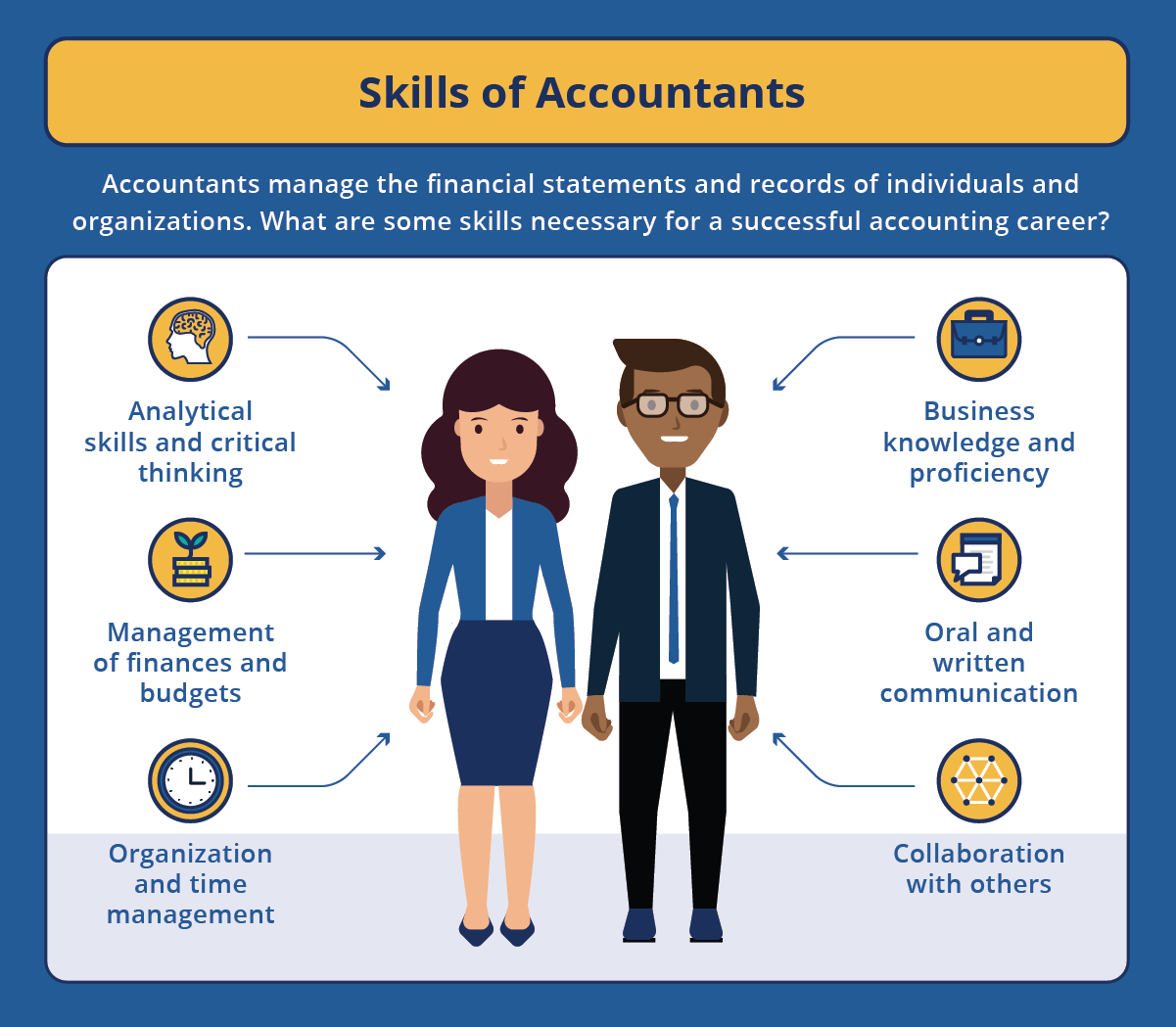

Accountants play a crucial role in helping small businesses thrive. They not only help with managing finances and taxes but also provide valuable insights and recommendations that can help your business grow. Here are a few reasons why having an accountant is essential for small businesses:

- Financial Guidance: Accountants can help you set financial goals, create budgets, and analyze your financial statements to ensure that your business is on the right track.

- Tax Compliance: Staying on top of tax laws and regulations can be daunting for small business owners. An accountant can help you navigate tax compliance and ensure that you’re not missing out on any deductions or credits.

- Business Growth: With their financial expertise, accountants can provide valuable insights that can help you make informed decisions and drive your business towards growth and success.

Choosing the Right Accountant for Your Small Business

When it comes to selecting an accountant for your small business, it’s important to choose someone who understands the unique challenges and needs of small businesses. Here are a few tips to help you find the right accountant:

- Look for Experience: Seek out accountants who have experience working with small businesses. They will be familiar with the specific needs and requirements of small business owners.

- Check Credentials: Make sure the accountant you choose is properly certified and licensed. Look for CPAs (Certified Public Accountants) or other relevant certifications.

- Ask for Referrals: Reach out to other small business owners in your network for recommendations on accountants they trust and have had positive experiences with.

Read more about accountant for small business here.

Frequently Asked Questions

What services can an accountant provide for my small business?

An accountant can provide a range of services for your small business, including bookkeeping, financial reporting, tax preparation, budgeting, and financial analysis.

How often should I meet with my accountant?

It’s recommended to meet with your accountant on a regular basis, such as quarterly or semi-annually, to review financial reports, discuss business performance, and plan for the future.

By partnering with the right accountant for your small business, you can not only ensure compliance with tax laws and regulations but also drive growth and success for your business. Take the time to find an accountant who is the right fit for your business and watch as your business flourishes.

Leave a Reply