An In-Depth Analysis of Modern Copy Trading Platforms

The financial landscape is continuously evolving, introducing innovative strategies that cater to both seasoned traders and beginners. One such innovation is the copy trading platform, a tool that has revolutionized the way people invest and trade.

What is a Copy Trading Platform?

A copy trading platform allows individuals to mimic the trades of seasoned traders. This method gives inexperienced traders exposure to the strategies of experts, facilitating learning and potentially leading to profitable outcomes.

How Does it Work?

Signing up on a copy trading platform involves selecting a trader whose strategies one wishes to follow. Once chosen, the platform will automatically replicate the selected trader’s moves in real-time. This automation ensures that users can benefit from the expert’s decisions without constant monitoring.

Key Features of a Copy Trading Platform

Several features make these platforms stand out:

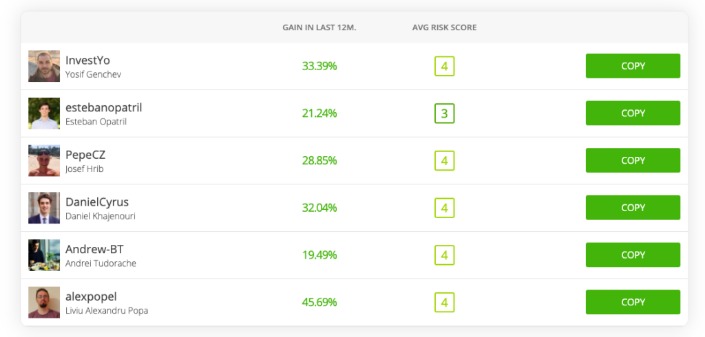

- Transparency: Users have access to the performance records of traders, enabling informed decisions.

- Flexibility: Investors can control the amount they invest and can stop copying trades at any time.

- Automation: Streamlines the trading process, making it accessible for those with limited time.

- Diversification: Following multiple traders can help mitigate risks by diversifying investment strategies.

Benefits of Using a Copy Trading Platform

The advantages of embracing a copy trading platform are manifold. They lower the barrier of entry for new traders, reduce the time commitment typically required for market analysis, and provide opportunities for diversified investment portfolios.

Risks to Consider

While the benefits are appealing, it’s crucial to understand the inherent risks:

- Market Risks: Even expert traders can make losses, and copying their trades doesn’t eliminate this risk.

- Dependency: Over-reliance on another’s strategy may prevent personal growth and understanding of market dynamics.

- Platform Reliability: The effectiveness of the copy trading platform itself can impact your returns.

Choosing the Right Platform

Read more about forex trade copying here.

To maximize the potential of a copy trading platform, consider the following when choosing one:

- Reputation: Research reviews and seek recommendations.

- Transparency: Look for platforms that provide comprehensive data on trader performance.

- Fee Structure: Be aware of any fees associated with the platform and how they might affect your returns.

Conclusion

A copy trading platform can be a game-changer for both novice and experienced investors. By making informed choices and understanding the risks, traders can leverage these platforms to potentially enhance their trading success.

Leave a Reply